Bahrain Financial expert Pria Masson Tanwar talks of financial investments

The concept of money has always been relative even during the barter system - a dance between how much to give and how much to receive in return. The concept of risk and return has the same idea at its roots. We risk our money each time we interact with it. When we buy something, we risk the realized return of what we buy. If we have money as cash, we do risk inflation which will mean the real value of that money has fallen. Investments and making your money grow, is therefore, a dance between the same risk and return.

At a time of a pandemic, safety has come to the forefront. Physical safety, emotional safety, and safety of wealth. However, with so many unknown parameters that drive wealth value, it is difficult to figure out where to put any excess money and how to rebalance existing investments to effectively safeguard the hard-earned money.

With that in mind, let us delve into some options of what you can do for financial investments, three popular investment avenues and my view on the way forward for them.

De-globalization could be here to stay – park your money where you have residential and legal stability

De-globalization could be here to stay – park your money where you have residential and legal stability

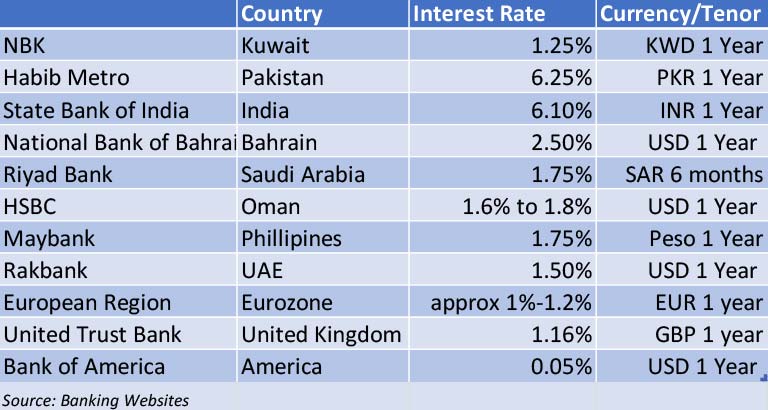

Savings accounts and fixed or term deposits are among the safest places for your money. However, world over, deposit rates are at almost all-time lows and it does not appear to be something that will change soon. Couple this with the trend towards “domestic safeguarding” that seems to have taken over most countries and irrespective of where you live, your money is probably safest where your passport belongs. As disturbing as this sounds, a certain amount of your savings, need to be as de-risked as possible and a savings account or term deposit in your home country meets that end

When uncertainty strikes – knowledge is safety

Equity markets have always been a bit of a confusing space, but rarely has this confusion been more evident than it is now. With uncertainty all around, all major economic parameters at low levels and continuous news of companies in distress, the rise in the major stock markets is a bit of a head-scratcher. On an average since the post-pandemic low point (March 24th, 2020), key global indices have risen by 30%. One of the reasons could be the fact that there are limited options for reasonable returns elsewhere. The questions then are, will these markets keep rising, and, should an average person also join this investment rally? No one has definite answers, but like all things related to money, it is a play between risk and reward, so hedge your risks and settle for moderate rewards.

One option is to investigate high performing mutual funds. Mutual funds allow you exposure to a basket of stocks on a specific stock exchange. This saves you having to invest in a specific stock and tracking it. Also investigate the concept of ETFs (Exchange Traded Funds) which is like a mutual fund for stock markets overall. So, if you invest in the S&P 500 ETF, you are invested into the performance of the S&P 500 index as a whole. Not into any individual stocks but into the entire index. These two avenues are safer than individual stocks in most cases.

Sometime, stocks are also relatively safe - when you invest with knowledge of a specific sector or company. So, if you understand technology, and invest in an upcoming tech stock, that is a safe bet. Or in current times, if you understand vaccine and want to back a vaccine manufacturer that would be a relatively safe bet too. As a caveat, safety is in relation to other equity investments. Equities as a class, are high risk.

Real Estate, Yield and Liquidity – Find that balance

Real Estate, Yield and Liquidity – Find that balance

Real estate has always been a preferred option as a long-term investment. You own the asset, hopefully the market grows and meanwhile, you get some rent. Currently, the lack of liquidity related to real estate assets offsets the apparent benefits – especially, if you have a loan attached to that. With office trends changing, companies in distress and of course employees in distress as well, the uncertainty of the real estate market makes is a risky proposition. To hedge that, invest in yielding assets – that means assets that give a reasonable rental yield based on sounds contracts. Real estate is still a good avenue but if you are not currently invested, waiting for the near term till the uncertainties play out - that may be a safer option.

Uncertainty often makes people want to have predictability and to plan more prudently. This drive towards higher yields can give a false sense of security. The key lies in moderation. Balance your investments across risk-reward matrices and be patient – quick money is usually risky money- and that is more in the area of a poker game. For now, play from a place of knowledge, play smart and temper expectations.

Pria is a strategy consultant and advisor. You can follow Pria on Instagram @money_cues or know more about her professional experience at http://www.i2d-consulting.com.